Industry Overview

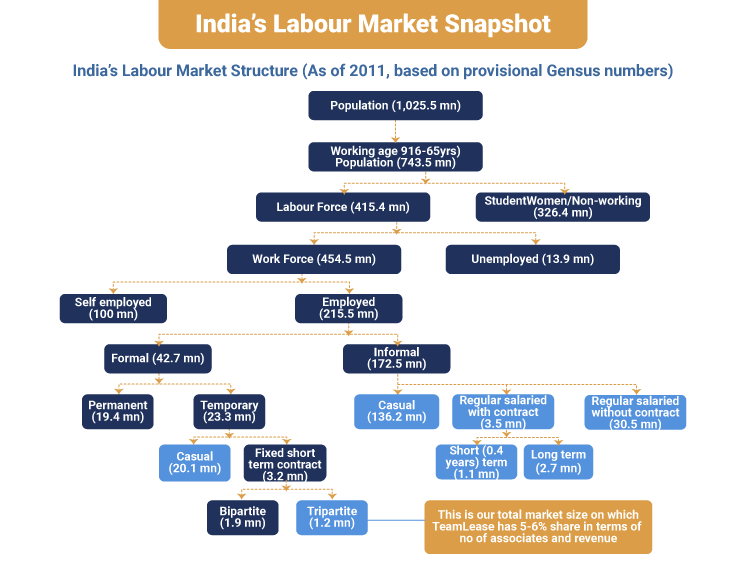

As per the CRISIL flexi-staffing industry report, India is the world’s second-largest labor market. Only around 10% of India's labour force works in formal employment. Redefining the nature of employment and having a greater amount of workers in formal employment will be critical if India's economic development is to become more broad-based, not only in terms of regions but also in terms of social inclusion.

Globally, the staffing and recruitment solutions industry has grown considerably over the past few years. According to the CIETT Economic Report 2014, the industry size had reached 11.5 million workers by the end of 2012. Thus, despite the slump in the aftermath of the financial crisis and the resultant economic slowdown, the industry still had a 7% growth rate over the last decade. A gradual movement towards a more formal setup to employment is anticipated due to various factors such as the increasing number of enterprises turning formal, skills development, and regulatory amends in favour of formal and flexi-staffing and recruitment solutions industries.

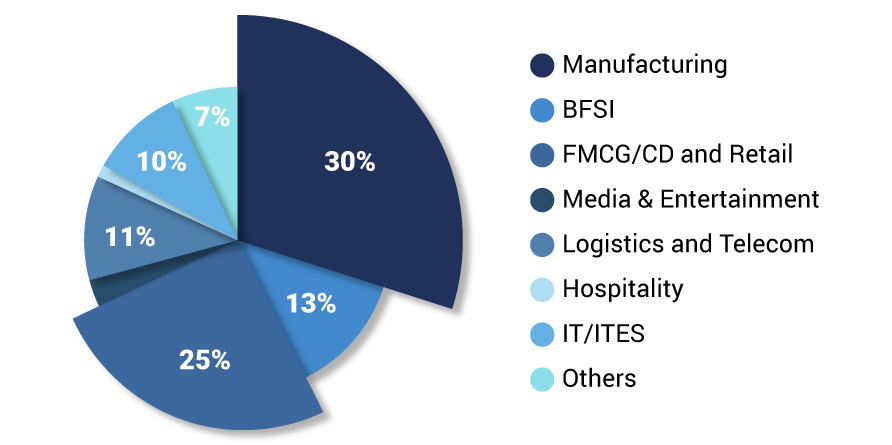

Segmental Mix

Source: CRISIL Research

Overall current industry growth:

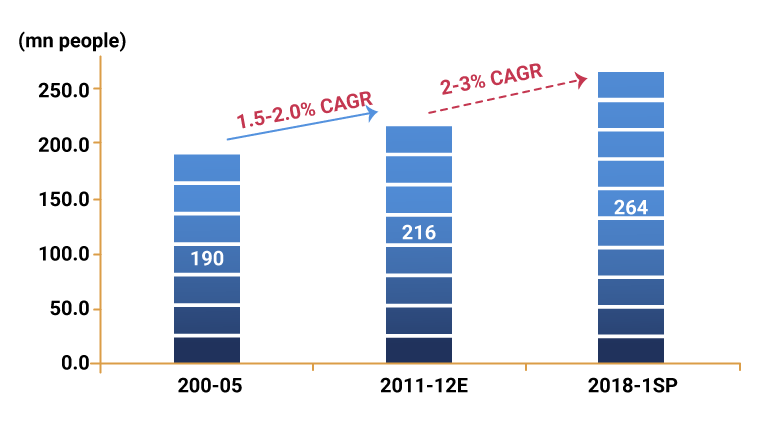

India’s staffing landscape is undergoing a transformation as the overall workforce is expected to grow at a CAGR of 2–3% during 2011–2012 to 2018–2019. Sectors such as manufacturing, financial, real estate, business services, and retail will continue to have a relatively higher proportion of the workforce. Sectors such as IT-enabled services and banking, financial services and insurance are expected to see comparatively higher growth in employment.

The Indian staffing industry is anticipated to play a crucial role in supporting employment growth. Contract and temporary staffing services are expected to witness increased demand, particularly in booming sectors like IT-enabled services and BFSI. This trend reflects evolving business needs, where flexibility and specialised skills provided by temporary staffing meet the dynamic workforce requirements of fast-growing sectors.

As more enterprises seek cost-effective workforce strategies, cost-effective staffing and recruitment solutions are gaining strong momentum. Organisations are increasingly outsourcing recruitment functions to expert staffing firms to ensure agility and compliance, while also managing hiring cycles efficiently.

Total Industry Employment (Data excludes employment in Agriculture)

Note: E: Estimated; P: Projected

Source: CRISIL Research

The formal workplace is expected to grow at a CAGR of 9–10% from 2011–12 to 2018–2019. This growth will span across sectors as new labour laws come into effect, and the overall workforce continues to expand. Apart from manufacturing, which is projected to comprise a large portion of the formal employee base, sectors such as FMCG and logistics are expected to contribute significantly to formal employment.

Flexi-staffing is anticipated to grow at a CAGR of around 20–25% between 2013–2014 and 2018–2019. While newer sectors such as e-commerce will drive fresh demand for indian staffing, the dominance of manufacturing—which still includes a large number of unorganised players—will remain. As companies seek long-term workforce solutions, many turn to experienced staffing firms to support the hiring process in a streamlined and compliant manner.

Amendments to labour regulations will likely increase the adoption of flexi-staffing, reinforcing the critical role of staffing companies in India. The hiring process is expected to become more efficient, transparent, and inclusive as more businesses engage with staffing companies in India to meet their workforce needs. In this evolving context, robust recruitment processes and expert guidance from reliable partners will shape the future of work.

In conclusion, recruitment processes that balance speed, quality, and compliance will be vital for achieving scalable, long-term workforce outcomes that support both employers and jobseekers in India.