Transforming the BFSI Sector through Upskilling and Reskilling

The Banking, Financial Services, and Insurance (BFSI) industry is essential to the Indian economy. It plays a key role in driving economic growth, ensuring financial security, and providing jobs. It mirrors broader economic trends and often bears the impact of economic fluctuations.

From FY16 to FY22, bank credit showed a compound annual growth rate (CAGR) of 8.5–9.5%, reaching $1,532.31 billion by FY22. Deposits also grew steadily at a CAGR of 10.92%, reaching $2.12 trillion by FY22, reflecting the sector’s consistent growth.

BFSI: Building the Indian Economy

The BFSI sector has contributed to economic growth and expanded financial inclusion, covering 230 million lives in India. This reflects its commitment to promoting financial access and economic growth through initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY).

Investments of $9.7 billion in BFSI and other sectors make it appealing for investors. Private equity and venture capital investments allocated 18% to this. In November 2022, there was a strong demand for credit in different areas. The sector is helping the economy and providing funding for many industries and services in the country.

India is committed to expanding digital transactions in the Indian economy, thereby improving the quality and vitality of the financial sector and the citizens’ quality of life. Digital payment transactions have increased considerably as a consequence of the coordinated efforts of the government as a whole and all stakeholders, from 2,071 crore in FY 17 – 18 to 8,840 Crore in FY 21 – 22.

Retail loans have been a major contributor to BFSI in recent years. Retail loans grew at a compound annual growth rate (CAGR) of 24.8 percent from March 2021 to March 2023, nearly double the CAGR of 13.8 percent for gross advances during the same period.

Navigating the Current Landscape of L&D in BFSI

The BFSI sector understands the significance of Learning and Development (L&D) programs. These programs are crucial for filling skill gaps, meeting expectations, and meeting customer expectations. Customer demands in the BFSI sector are frequently shifting. Today’s customers expect seamless digital experiences, personalized services, and rapid problem resolution. L&D programs must adapt and align with changing customer requirements to meet these expectations. This includes training employees in customer-centric skills, improving communication, and fostering a culture of responsiveness and innovation.

Opportunities for Upskilling and Reskilling in BFSI

The BFSI sector is changing quickly because of technology, customer preferences, and regulations. This dynamic environment presents numerous opportunities for upskilling and reskilling within the industry. Banking, finance, insurance, and investment professionals can benefit from learning digital skills. They can also benefit from learning about data analysis for better decision-making and customer interaction.

Cybersecurity expertise is also in high demand as the sector faces growing threats. Moreover, with the rise of fintech and blockchain, employees can explore opportunities to learn about these disruptive technologies. Soft skills like communication, adaptability, and problem-solving are essential for providing exceptional customer experiences and navigating the sector’s complexities.

Continuous learning and development are crucial for BFSI to stay competitive and meet customers’ evolving needs in this ever-changing work landscape. Learning new skills is important for both individuals and organizations in the BFSI sector to stay innovative and strong.

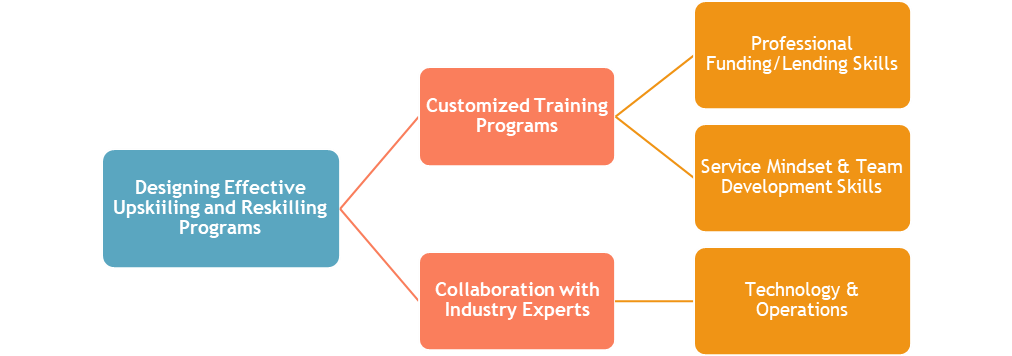

Strategies to Upgrade BFSI Talent Pool through Upskilling and Reskilling

- L&D programs use technology to provide training to BFSI professionals for niche roles. This includes interactive story-based learning, scenario-based e-learning platforms, virtual classrooms, and gamification.

- Gamification can significantly increase employee engagement in L&D programs in the BFSI sector. Turning training modules into interactive and enjoyable experiences can improve completion rates and enhance learning outcomes.

- Leaderboards, scoring, badges, and levels motivate learners. They engage in problem-solving and remember information. This helps them apply what they’ve learned in their jobs.

- Another critical benefit of gamification is its ability to provide companies with real-time and actionable data. This data helps organisations track employee progress and find areas for improvement, making data-driven decisions to improve training programs.

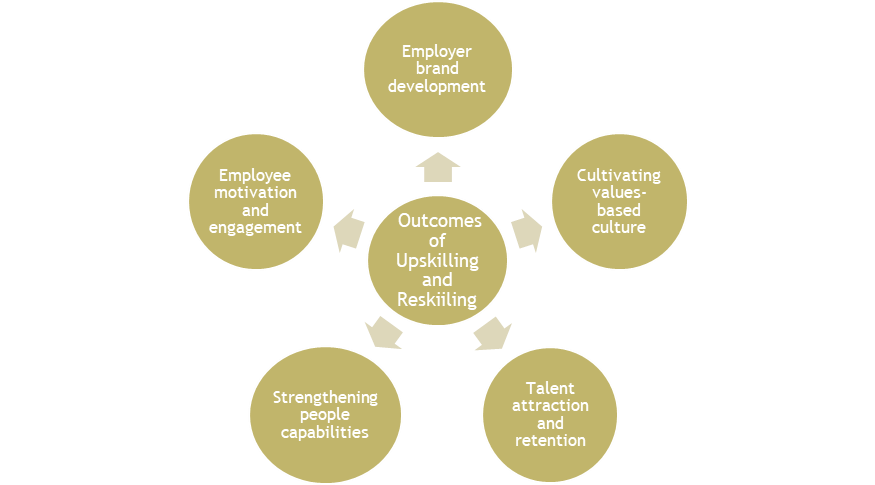

Driving Success: The Positive Impact of Upskilling and Reskilling in BFSI

Employee Retention: Continuous upskilling and professional development significantly impact employee retention. A good learning culture helps keep employees engaged. Investing in L&D is important for this.

In-demand skills: Software development, IT banking, insurance expertise, and financial analysis are needed by employers. L&D can significantly contribute to developing these skills.

Employer Brand Development: L&D results improve a business’s brand, allowing it to attract and keep top talent, increase employee involvement, and, in the end, boost efficiency and performance.

Conclusion

The Banking, Financial Services, and Insurance (BFSI) sector stands out as a strong base in the complex Indian economy. It supports economic growth, financial security, and job possibilities. The statistics for the last five years underline its unwavering growth trajectory, with bank credit and deposits witnessing substantial expansion.

To keep growing and adapting to changes in the BFSI sector, L&D programs are necessary. These programs must adapt to meet the evolving needs of both customers and employees. This includes upskilling and reskilling initiatives that empower professionals with digital literacy, data analytics, cybersecurity, and soft skills.

The positive impact of upskilling and reskilling in BFSI is far-reaching. It leads to improved employee retention, specialised skill development, and an organisation’s employer brand enhancement.

BFSI companies can become industry leaders by investing in their workforce. They can also drive innovation and ensure financial inclusion and stability for millions in India. Continuous learning and development are crucial for the BFSI sector’s success in the ever-changing business era.

Latest Blogs

Permanent vs. Contract Staffing: What’s Right for Your Business?

Workforce strategy matters now more than ever in India’s evolving employment landscape. As businesses strive for growth, efficiency, and regulatory compliance, choosing between permanent staffing...

Read MoreApprenticeship Programs vs Internship: Understanding the Difference

As India sharpens its focus on employability, workforce formalization, and industry-aligned skilling, the conversation around apprenticeship programs vs. internship has become increasingly important. For employers,...

Read MoreApprenticeship India: A Guide to NAPS, NATS & Compliance

As India strengthens its workforce strategy, apprenticeship initiatives in India are gaining renewed relevance for employers across sectors. With skill gaps widening and compliance requirements...

Read MoreHow Apprenticeships in India Help Build Job-Ready Talent?

In a fast-evolving job market, businesses across India face a common challenge: finding candidates who are not just qualified on paper but ready to perform...

Read MoreStrategic Workforce Planning in India: Why Smart Talent Strategy is Important?

For years, strategic workforce planning in India was treated as a back-office exercise—something to be revisited when hiring pressure built up or attrition spiked. That...

Read More