Transforming the BFSI Sector through Upskilling and Reskilling

The Banking, Financial Services, and Insurance (BFSI) industry is essential to the Indian economy. It plays a key role in driving economic growth, ensuring financial security, and providing jobs. It mirrors broader economic trends and often bears the impact of economic fluctuations.

From FY16 to FY22, bank credit showed a compound annual growth rate (CAGR) of 8.5–9.5%, reaching $1,532.31 billion by FY22. Deposits also grew steadily at a CAGR of 10.92%, reaching $2.12 trillion by FY22, reflecting the sector’s consistent growth.

BFSI: Building the Indian Economy

The BFSI sector has contributed to economic growth and expanded financial inclusion, covering 230 million lives in India. This reflects its commitment to promoting financial access and economic growth through initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY).

Investments of $9.7 billion in BFSI and other sectors make it appealing for investors. Private equity and venture capital investments allocated 18% to this. In November 2022, there was a strong demand for credit in different areas. The sector is helping the economy and providing funding for many industries and services in the country.

India is committed to expanding digital transactions in the Indian economy, thereby improving the quality and vitality of the financial sector and the citizens’ quality of life. Digital payment transactions have increased considerably as a consequence of the coordinated efforts of the government as a whole and all stakeholders, from 2,071 crore in FY 17 – 18 to 8,840 Crore in FY 21 – 22.

Retail loans have been a major contributor to BFSI in recent years. Retail loans grew at a compound annual growth rate (CAGR) of 24.8 percent from March 2021 to March 2023, nearly double the CAGR of 13.8 percent for gross advances during the same period.

Navigating the Current Landscape of L&D in BFSI

The BFSI sector understands the significance of Learning and Development (L&D) programs. These programs are crucial for filling skill gaps, meeting expectations, and meeting customer expectations. Customer demands in the BFSI sector are frequently shifting. Today’s customers expect seamless digital experiences, personalized services, and rapid problem resolution. L&D programs must adapt and align with changing customer requirements to meet these expectations. This includes training employees in customer-centric skills, improving communication, and fostering a culture of responsiveness and innovation.

Opportunities for Upskilling and Reskilling in BFSI

The BFSI sector is changing quickly because of technology, customer preferences, and regulations. This dynamic environment presents numerous opportunities for upskilling and reskilling within the industry. Banking, finance, insurance, and investment professionals can benefit from learning digital skills. They can also benefit from learning about data analysis for better decision-making and customer interaction.

Cybersecurity expertise is also in high demand as the sector faces growing threats. Moreover, with the rise of fintech and blockchain, employees can explore opportunities to learn about these disruptive technologies. Soft skills like communication, adaptability, and problem-solving are essential for providing exceptional customer experiences and navigating the sector’s complexities.

Continuous learning and development are crucial for BFSI to stay competitive and meet customers’ evolving needs in this ever-changing work landscape. Learning new skills is important for both individuals and organizations in the BFSI sector to stay innovative and strong.

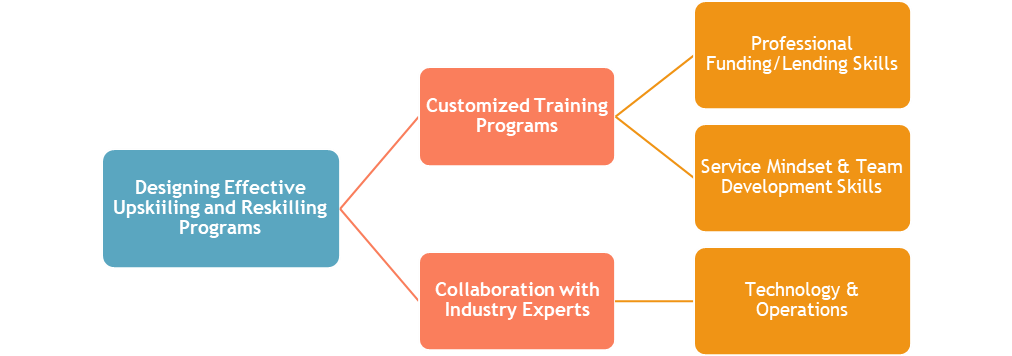

Strategies to Upgrade BFSI Talent Pool through Upskilling and Reskilling

- L&D programs use technology to provide training to BFSI professionals for niche roles. This includes interactive story-based learning, scenario-based e-learning platforms, virtual classrooms, and gamification.

- Gamification can significantly increase employee engagement in L&D programs in the BFSI sector. Turning training modules into interactive and enjoyable experiences can improve completion rates and enhance learning outcomes.

- Leaderboards, scoring, badges, and levels motivate learners. They engage in problem-solving and remember information. This helps them apply what they’ve learned in their jobs.

- Another critical benefit of gamification is its ability to provide companies with real-time and actionable data. This data helps organisations track employee progress and find areas for improvement, making data-driven decisions to improve training programs.

Driving Success: The Positive Impact of Upskilling and Reskilling in BFSI

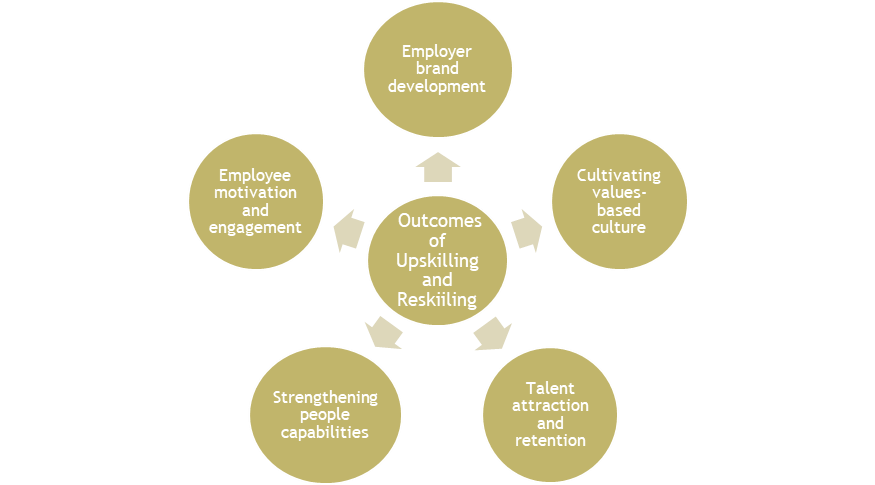

Employee Retention: Continuous upskilling and professional development significantly impact employee retention. A good learning culture helps keep employees engaged. Investing in L&D is important for this.

In-demand skills: Software development, IT banking, insurance expertise, and financial analysis are needed by employers. L&D can significantly contribute to developing these skills.

Employer Brand Development: L&D results improve a business’s brand, allowing it to attract and keep top talent, increase employee involvement, and, in the end, boost efficiency and performance.

Conclusion

The Banking, Financial Services, and Insurance (BFSI) sector stands out as a strong base in the complex Indian economy. It supports economic growth, financial security, and job possibilities. The statistics for the last five years underline its unwavering growth trajectory, with bank credit and deposits witnessing substantial expansion.

To keep growing and adapting to changes in the BFSI sector, L&D programs are necessary. These programs must adapt to meet the evolving needs of both customers and employees. This includes upskilling and reskilling initiatives that empower professionals with digital literacy, data analytics, cybersecurity, and soft skills.

The positive impact of upskilling and reskilling in BFSI is far-reaching. It leads to improved employee retention, specialised skill development, and an organisation’s employer brand enhancement.

BFSI companies can become industry leaders by investing in their workforce. They can also drive innovation and ensure financial inclusion and stability for millions in India. Continuous learning and development are crucial for the BFSI sector’s success in the ever-changing business era.

Latest Blogs

Financial Inclusion in India: Tech’s Impact on BFSI and Jobs

How Technological Advancements Aid Expansion and Impact Job Creation Earlier this year, the Finance Minister emphasized India's need for significantly larger banks, potentially three times...

Read MoreE-commerce in India: Distribution Channels and the Way Forward

Factors Affecting Channels of Distribution Consumer Preferences: Indian consumers are becoming more discerning and demanding, influencing distribution strategies. They seek convenience, quality, and a wide...

Read MoreThe Importance of Diversity and Inclusion: Beyond the C-Suite Directive

Closing inclusivity gap In an era marked by profound demographic shifts, technological advancements, and global interconnectedness, diversity and inclusion are more crucial than ever. A...

Read MoreThe Production Linked Incentive – Journey so Far

Slowing Investment in Key Sectors Under PLI Scheme in India Investment in key sectors identified to boost domestic manufacturing under the Centre's Production-Linked Incentive (PLI)...

Read MoreFormalisation of India’s Labour Market

Government Initiatives The government has launched several initiatives aimed at transitioning to a more formal labour market: Make in India: This initiative aims to make...

Read More